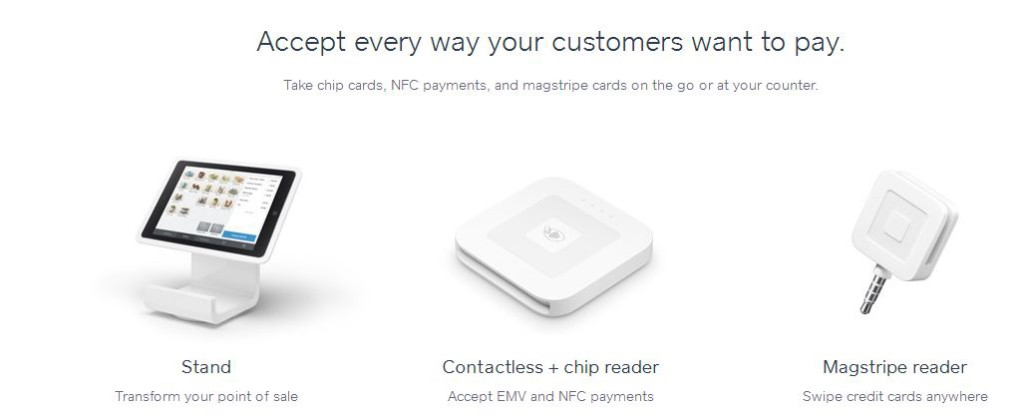

Square Mobile Credit Card Reader Options

The image above is from SquareUp.com and shows some of the different types of credit card processing equipment they offer. First, let’s take a look at the Stand option. At the time of our Square review the Stand retails for $99 and is very easy to set up. You iPad simply plugs into the Stand; download the Square Register software and you can easily input inventory and create transaction details. The Square Stand comes with a built in card reader (see the image below), making it easy to swipe a credit card and process the credit card payment. The Stand can be mounted to your counter top or cash drawer with a screw or can be held in place with an adhesive mount. The Square Stand is compatible with the iPad Air or iPad with Retina Display. The Stand will swivel in a full circle and tilts to different angles to make it easy for customers to sign for the transaction. The Square Register software allows you to customize options such as printing, emailing, or even texting a receipt, collecting customer feedback through digital receipts, managing inventory, creating custom employee logins, adding taxes, tipping, and discounts, and much more!

The second option is the Magstripe reader. The Magstripe reader is a free option that pairs with the free Square Register app. As you can see from the first image above, this small square device works through a headphone jack; simply plug it into the headphone jack on your mobile phone or tablet. All transactions processed with Square equipment are completely secure and encrypted at the time of processing. No customer information is stored locally on any device so you can assure you customers that every transaction is completely safe and secure.

A third choice is the Contactless and chip reader option, This equipment is perfect for accepting NFC (Near Field Communication) or contactless payments, like Apple Pay, and also allows for EMV chip cards, whether they are contactless or need to be inserted into the card reader. The Square contactless and chip reader sales for $49, at the time of this Square review, and comes with a free magstripe reader as well. The contactless and chip reader works wirelessly or can be plugged into the Square Stand to charge while you are processing payments. With new liability changes in place regarding EMV chip cards you’ll want to make sure you have the ability to read the EMV chip so that your business isn’t liable for any fraudulent chargers made on a card with an EMV chip. Make sure you are aware of the requirements within your business industry. The contactless square is small, measuring approximately 2.6 inches square, take it with your or keep it on the counter next to your Stand. Both the Magstripe reader and Contactless/Chip readers are also compatible with Android devices running 4.0 or later.

Square Payment Processing Fees

Square has relatively small processing fees; from swiped, tapped or contactless transactions the fee is a flat 2.75%. For keyed in transactions, when someone calls in an order or places an order online and the card is not present, the fee is 3.5% + .15 cents per transaction. Check with your merchant account provider to see how they integrate with Square payment options. Most of the bigger merchant account providers, like Cayan, can fully integrate to have your payments processed and added into your merchant account within 1 to 2 business days.

National Card Payments

- No Set Up Fees

- No Minimum Monthly Fees

- Better pricing than Costco, PayPal, and Square!

Durango Merchant Services

- Fast Approval

- Bad Credit or High Risk Account Options

- Rates starting at 2%

eMerchantBroker

- 24 Hour Approval

- Domestic and Offshore High Risk Accounts

- ACH, MOTO, Online Sales, POS…